Some common factors for Earring quality control:

Appearance

Quantity check

Measurement(weight & size)

Basic function check

Barcode scan

3M tape test for Logo

Some common factors for Earring quality control:

Appearance

Quantity check

Measurement(weight & size)

Basic function check

Barcode scan

3M tape test for Logo

Some common factors for Waste Processor quality control:

Appearance

Quantity check

Measurement(weight & size)

Hi-pot test

Grounding test

Basic function check

Current leakage test

Input power test

Motor rotate speed test

Noise test

Assembly test

Drop test

Remote control function test

Rubbish process test

Power cord pull test

Barcode scan

3M tape test for Logo

Some common factors for Ashtray quality control:

Appearance

Quantity check

Measurement(weight & size)

Basic function check

Horizontal test

Slope test

Drop test

Smell test

Barcode scan

3M tape test for Logo

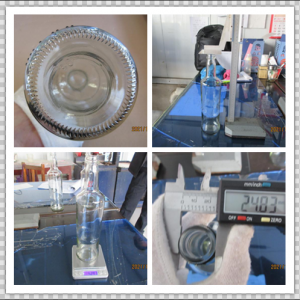

Some common factors for Glass Bottle quality control:

Appearance

Quantity check

Measurement(weight & size)

Stability test

Barcode scan

3M tape test for Logo

Some common factors for Fiber laser cleaning machine quality control:

Appearance

Quantity check

Measurement(weight & size)

Basic function check

Moving test

Noise test

Barcode scan

3M tape test for Logo

Back on December 15, 1991, China’s first self-designed and self-built nuclear power plant, Qinshan Nuclear Power Plant, was connected to the grid, ending the history of no nuclear power in the Chinese mainland. China has become the seventh country in the world to design and build its own nuclear power plants.

In the past 30 years, on the basis of the Qinshan Nuclear Power Plant, known as the “glory of the nation”, China’s nuclear industry has achieved a historic leap in overall technology and management, and a number of large nuclear power bases, such as Tianwan, Fuqing, Changjiang and Sanmen, have been built. On January 30 this year, China’s own third-generation nuclear power technology hualong One, the world’s first nuclear reactor, China National Nuclear Corporation Fuqing Nuclear Power Unit 5, was put into commercial operation, making China a leader in the world in third-generation nuclear power technology. Currently, China ranks third in the world in operating nuclear power units and first in the world in nuclear power units under construction.

From scratch, from small to large, not only leading in scale, but also innovative development. The development of China’s nuclear industry can not be separated from the hard work and pioneering innovation of generations of builders. Ye Qizhen, academician of the Chinese Academy of Engineering, and other outstanding figures of Qinshan Nuclear Power Received awards at the 30th anniversary report on safe power generation of Qinshan Nuclear Power Plant held by CNNC and China Nuclear Power Innovation and Development Forum on December 15.

At present, Qinshan Nuclear Power has 735 patents and 2 ISO international standards. “Hualong One” meets the highest international safety standards in terms of safety, while all the core equipment has been made in China, with 88% of the first set being made in China, fully equipped with the capability of mass construction…

Nuclear group party secretary, chairman of the board in the jian-feng yu said, from qinshan to fuqing nuclear power “poor” started from the technology in China, the independent million kilowatt nuclear plant design, construction, our country has become the world’s one of a handful of countries with complete industry system, and on this basis to form the complete nuclear power industry chain, to realize the large-scale development of nuclear power.

Safety is the lifeblood of the nuclear industry. Over the past 30 years, China’s nuclear power units have maintained a good safety record, improved operation management level year by year, and significantly improved the safety and economy of units. In 2020, 15 operational nuclear power units of CNNC received full marks in WANO index, and since 2021, 16 operational nuclear power units have received full marks in WANO Index, reaching the world’s leading level.

The Qinshan Nuclear Power Plant has nine operating units with a total installed capacity of 6.6 million kilowatts and an annual generating capacity of about 52 billion kilowatt hours. So far, the Qinshan Nuclear Power Base has generated more than 690 billion kilowatt-hours of electricity, equivalent to 653 million tons of carbon dioxide reduction, and 433 West Lake scenic spots have been planted with trees.

The “green report card” of Qinshan Nuclear Power Is the epitome of the green economic and social development boosted by nuclear energy. Yu jianfeng said that it is an important responsibility and mission for CNNC to achieve peak carbon neutrality in China, as well as a major opportunity to achieve high-quality development.

Not long ago, the “Opinions of the CPC Central Committee and The State Council on Fully, Accurately and comprehensively Implementing the New Development Philosophy to Achieve Carbon neutrality” clearly stated that nuclear power should be actively, safely and orderly developed. According to the 2030 Carbon Peak Action Plan, the layout and development schedule of nuclear power plants should be properly determined, and the orderly development of nuclear power plants should be maintained on the premise of ensuring safety, and the steady pace of construction should be maintained.

Industry experts believe that achieving carbon neutrality will lead to a green and low-carbon transition in the economy and society, especially in the energy sector.

At present, China’s coal consumption is relatively high, the weak stability of renewable energy and other factors, the adjustment of energy structure is still a great challenge. Nuclear power generates electricity in a safe, efficient and clean way and operates stably and reliably, offering a realistic option to deal with global climate change, Ye said.

Zhou Shifeng, vice president of Zhejiang Development Planning Research Institute, proposed that Zhejiang should develop nuclear power projects in accordance with the principle of “positive, safe and orderly” in the next step, promote the construction of zero-carbon future city (park) in nuclear power bases, and encourage the comprehensive utilization of nuclear energy such as nuclear energy heating and hydrogen production.

Experts and scholars from Guangdong, Hong Kong and Macao expressed their views on “the construction of an international financial hub in the Greater Bay Area and the opening up of financial institutions”.

As the financial cooperation in the Guangdong-Hong Kong-Macao Greater Bay Area has made a series of breakthroughs, further exploring the opening of the financial system has become an essential part of the construction of the Greater Bay Area as an international financial hub. The fourth Guangdong-Hong Kong-Macao Greater Bay Area Financial Development Forum, co-hosted by the Financial Research Institute of the Development Research Center of The State Council and the Guangdong Provincial Financial Supervision Administration, was held in Guangzhou recently. Central ministries and commissions, financial industry experts, financial authorities, financial institutions and scientific research institutions in Guangdong, Hong Kong and Macao put forward their respective views on the construction of the Greater Bay Area as an international financial hub and the opening of financial institutions.

Experts and scholars believe that to accelerate the integration of the Greater Bay Area into the new development pattern, it is necessary to deepen the reform and opening up of the financial sector and drive the high-quality development of other economic fields with the high-quality development of the financial sector. At the same time, we can take advantage of the special financial advantages of the Greater Bay Area and take the Guangdong-Macao In-depth Cooperation Zone and the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone as institutional innovation platforms to actively and orderly explore new measures of financial system-based opening-up and gradually promote mutual recognition, mutual learning and convergence of financial system rules.

Focusing on institutional opening pays attention to pioneering exploration

Finance is the core of modern market economy. Based on the new development stage, the Greater Bay Area can not implement the new development concept and integrate into the new development pattern without the guidance and promotion of finance. “To fulfill the new important mission entrusted to the Greater Bay Area by the new development pattern, the Greater Bay Area should continue to play a leading role in reform, opening-up and economic development, and strive to build the Greater Bay Area into a strategic fulcrum for the construction of a new development pattern.” Zhang Jungu, deputy director of the Development Research Center of The State Council, said at the forum that to accelerate the integration of the Greater Bay Area into the new development pattern, it is necessary to deepen the reform and opening up of the financial sector, and use the high-quality development of the financial sector to drive the high-quality development of other economic fields.

In this regard, Tong Shiqing, deputy director of the Guangdong Provincial Financial Regulatory Bureau, believes that the cross-border financial opening and cooperation between Guangdong, Hong Kong and Macao has formed a variety of modes such as market interconnection, mutual establishment of institutions and mutual recognition of products. Promoting the opening of financial system will be the focus of the next stage of deepening cross-border financial cooperation in the Guangdong-Hong Kong-Macao Greater Bay Area. “The opening up of the financial sector in Guangdong, Hong Kong and Macao should focus more on pioneering exploration and integrated innovation, and take the lead in integrating with high-standard international rules.” Tong Shiqing said.

In terms of institutional convergence and integration, Tong shiqing said that for some new financial forms, if the system is not perfect, Guangdong, Hong Kong and Macao can timely strengthen communication and coordination, jointly formulate unified rules, form the “System scheme of The Guangdong-Hong Kong-Macao Greater Bay Area”, and contribute “wisdom of the Guangdong-Hong Kong-Macao Greater Bay Area”.

He Guofeng, deputy director of the POLICY Research Bureau of the CBRC, said that the CBRC encourages guangdong, Hong Kong and Macao to unify their green finance standards and enhance China’s voice and influence in the international green transformation. He Guofeng also revealed that CBRC supports the establishment of an insurance service center in the Greater Bay Area, and has formed a preliminary plan in terms of establishment principles, organizational form and design procedures.

At the forum, the financial authorities of the three places shared their progress in opening up their financial systems. Chen Shouxin, chairman of Macao’s Monetary Authority, said the central bond custodian system, the core infrastructure of Macao’s bond market, would soon be launched. In order to encourage enterprises in Hengqin Guangdong-Macao Deep Cooperation Zone to use Macao market for direct financing, the financial department of Shenhe District is studying and issuing special support measures to support enterprises to issue bonds in Macao, and giving appropriate incentives to intermediary service institutions in Shenhe District.

Lau Ying-pan, deputy chief executive of the Hong Kong Monetary Authority (HKMA), said that more convenience measures are being studied. One of them is to test the technology with the People’s Bank of China for the use of the digital yuan in Hong Kong, hoping to provide more payment options for residents of both places in the future.

“The expansion, deepening and continuous development of connectivity in the past decade and more have witnessed the country’s continued reform, opening-up and innovation on the premise of properly managing risks.” Paul Chan, financial secretary, said Hong Kong would continue to work with relevant mainland ministries to expand plans for various financial connectivity schemes and to optimize arrangements for existing schemes.

Financial connectivity has injected lasting momentum into cross-border financing

In September this year, the pilot business of “Cross-border financial link” was officially launched, bringing new development opportunities for the greater Bay Area to develop a multi-functional and multi-level financial market. Following this, Guangzhou proposed to seize the opportunity of the “Cross-border financial link” pilot project to build a financial management and asset management center in the Guangdong-Hong Kong-Macao Greater Bay Area. At this forum, topics related to residents’ investment and financing, such as “cross-border financing”, “financing” and “capital management”, have become the focus.

Qiu Yitong, director of guangzhou Local Financial Supervision Bureau, revealed guangzhou’s plan to build the financial management and asset management center of The Guangdong-Hong Kong-Macao Greater Bay Area at the forum, that is, to build three central carrying areas with central, eastern and southern branches in spatial layout, with the Pearl River as the link, across the two sides of the Pearl River, along with the pace of Guangzhou’s development from east to south. In addition, Guangzhou will accelerate the establishment of the Hong Kong and Macao Insurance Service Center in Nansha District, strive to take the lead in undertaking the cross-border “insurance Link” business pilot in the Greater Bay Area in the future, promote the establishment of the Guangdong-Hong Kong-Macao Greater Bay Area international commercial Bank and build it into a high-quality sample of the original cross-border asset management institutions in the Greater Bay Area.

The construction of the Cross-border Wealth management and asset management Center in the Greater Bay Area is believed to bring great opportunities to the wealth management business in the Greater Bay Area. “The construction of the Greater Bay Area International asset Management Center is the supporting requirements for the Greater Bay Area to become an international science and technology innovation center with global influence, and an important embodiment of the high-quality development of financial services in the Greater Bay Area.” “Li Tong, CEO and CEO of Bank of China International Holdings and vice chairman of the Hong Kong Chinese Securities Industry Association, said at the forum.

Silver protects inspect bureau party committee member and deputy director of the guangdong xiao-yong Chen said that guangdong silver protects inspect bureau to actively promote a large bay area of guangdong insurance service center set up, under the guidance of silver in China insurance regulatory commission, led jointly with silver protects inspect bureau of shenzhen and Hong Kong and Macao financial regulators held several rounds of discussion meeting, to study and draft the preparation plan, besides, promote each work orderly, Strive to include insurance service center construction into the CEPA framework as soon as possible and promote its implementation.

“The cross-border financial Link is just the beginning, and we look forward to expanding and improving the plan through practice to further meet the investment and financial needs of residents in the area.” Mr Chan also revealed at the forum that Guangdong and Hong Kong were working hard to follow up on the Proposal of the Hong Kong insurance industry to set up after-sales service centres in mainland cities in the Greater Bay Area, and to implement the “equivalent pre-recognition” policy for the insurance of Hong Kong cars driving in Guangdong via the Hong Kong-Zhuhai-Macao Bridge at an early date.

Technology empowers green finance to boost bay Area development

How should the financial construction of the Guangdong-Hong Kong-Macao Greater Bay Area be further promoted? At the forum, a number of participants suggested that featured finance should be taken as an important breakthrough for the high-quality development of the financial industry in the Greater Bay Area. In particular, the Greater Bay Area should seize the commanding heights of green finance, promote green development and help achieve the goal of “dual carbon”.

Data show that the fintech competitiveness of core cities in the Greater Bay Area ranks first in the world. At the forum, Zhang Junguo believed that accelerating the development of science and technology finance, helping the Greater Bay Area to become an international science and technology innovation center, promoting self-reliance and self-improvement of science and technology, and consolidating the foundation of industrial development are the primary and core tasks of building a new development pattern.

Wang Xin, director of the Research Bureau of the People’s Bank of China, suggested that fintech in the Greater Bay Area should focus on the four core areas of people’s livelihood, universal benefit, green and low-carbon, and RMB internationalization. At the same time, in establishing and improving the collaborative development mechanism of fintech in the Greater Bay Area, it is necessary to strengthen the top-level design, formulate the fintech development plan of the Greater Bay Area, clarify the development orientation of core cities in it, and accelerate the formation of a sound pattern of benign competition and coordinated development of fintech in the Greater Bay Area. “For example, we can give full play to the advantages of Hong Kong’s high status as an international financial center, Shenzhen’s active market players in scientific and technological innovation, and Guangzhou’s strong research institutes, strengthen the integration of fintech resources in the Greater Bay Area, and strengthen the network synergies of core cities connected by points and by lines.” Wang Xin said.

Participants also discussed how the Greater Bay Area should seize the opportunities of green finance in the greater Bay Area market under the “dual carbon” target.

An Qingsong, president of The Securities Industry Association of China, suggested that the Greater Bay Area should establish a green financial information statistical platform, establish unified green financial standards, provide green certification and counseling services, and optimize the channels for the securities industry to directly provide investment and financing services to the digital industry and green industry, so as to promote the green development of regional economy.

Chan pointed out that Hong Kong is leading international funds to support the country’s transition to a green economy, and will encourage more mainland local governments, institutions and enterprises to conduct green financing and certification through Hong Kong’s capital market to support the construction of green projects.

Service green development related varieties are widely concerned guangzhou Futures Exchange development of one of the four sectors. Li Zhen, deputy general manager of Guangzhou Futures Exchange, said green development products will be the core sector of The exchange, including carbon futures, power futures and industrial silicon and lithium futures closely related to the new energy industry.

Tong shiqing said that the standards and systems of green finance in the international community are not yet complete and formed. Guangdong, Hong Kong and Macao can establish a unified and quantifiable green finance identification standard and authoritative rating system, and unify standards and enrich products in green credit, green bonds, green insurance and green investment. We will continue to lead the Guangdong-Hong Kong-Macao Greater Bay Area in institutional opening-up.

China customs and South Africa Customs recently signed a mutual recognition arrangement for certified business operators, according to a customs release.

An “Authorized Economic Operator” is an Authorized Economic Operator, often referred to as AEO. AEO system is a system advocated by the World Customs Organization, in which the customs certifies and recognizes enterprises with high law-abiding degree, credit status and safety level, and gives them convenience and preferential measures. By carrying out AEO mutual recognition cooperation, Chinese customs and customs AEO enterprises of countries (regions) that recognize each other can directly enjoy the customs clearance facilitation measures implemented by local customs for the goods exported to each other, thus reducing trade costs.

From January to October 2021, the total value of China-africa import and export reached us $207.067 billion, up 37.5% year on year. As the most economically developed country in Africa, South Africa is also an important participant in the Belt and Road Initiative. From January to October 2021, the total import and export volume between China and South Africa reached US $44.929 billion, up 56.6% year on year, accounting for 21.7% of the total trade volume between China and Africa, making China’s largest trading partner in Africa.

Chinese customs and achieve mutual recognition, the customs in South Africa, the two countries AEO enterprise goods will be lower in the customs clearance documents audit rate, low inspection rate, priority to solve the problem of customs clearance, inspection, designated liaison communication very period priority rapid disposal of five types of mutual recognition of convenience measures, such as to a certain extent, reduce the cost of enterprise port, logistics and other trade We will vigorously promote safe and smooth trade between businesses of the two countries and create a more convenient business environment for the two countries to expand trade and investment.

So far, China has signed AEO mutual recognition arrangements (agreements) with 47 countries (regions) from 21 economies, including Singapore, South Korea and South Africa. The import and export volume of Chinese AEO enterprises to AEO countries (regions) with mutual recognition accounts for about 60% of their total import and export volume. ー step, China customs will be to build “area” countries, the regional comprehensive economic partnership agreement (RCEP) members, central and eastern European countries and important trade country customs as the key point, expanding AEO mutual recognition “friends”, speed up the AEO mutual recognition of the consultation process, for the import and export enterprises in our country in the world for more convenient, help enterprise to develop high quality.

Twenty years ago on December 11, China formally joined the World Trade Organization (WTO). The industry generally believes that China and the world win – win 20 years after joining the WTO.

As Wto Deputy Director-General Zhang Xiangchen said, China’s accession to the WTO has established stable policy expectations for its trading partners. China’s integration into economic globalization has provided a huge market space for the world.

However, in recent years, the WTO has faced many challenges. In particular, by the end of 2019, the WTO had suffered its most serious crisis since its establishment. The appellate body, known as the “pearl in the CROWN of the WTO”, was officially suspended, and the dispute settlement mechanism was paralyzed. Then, the world was hit by the COVID-19 pandemic, and the volume of global trade plunged.

How can China play a positive role when the global multilateral trading system faces the impact of protectionism?

Weaker WTO role?

With the formal suspension of the appellate body, some argue, the WTO’s role in global trade has diminished.

Zhang Jianping, director of the Regional Economic Research Center under the Ministry of Commerce’s Research Institute, told China News Service Guoshiqi that the US obstructing and sabotaging the appellate body cannot substantially damage the role and influence of the WTO on global trade. Because trade friction cases and the amount of money involved in the overall global trade is still very low.

Ni Yueju, a researcher at the Institute of World Economics and Politics of the Chinese Academy of Social Sciences, told China News Service that the WTO dispute settlement mechanism is a pillar of the WTO, and its suspension will inevitably affect the WTO’s role in global trade.

“But we know that the erosion of the WTO’s role began with the doha round dragging on, and that is the main reason why regional and bilateral free trade agreements have gained momentum since the beginning of the 21st century.” Ni pointed out that besides dispute settlement, WTO’s functions also include making trade rules and expanding trade and investment liberalization and facilitation. Any loss or weakening of its functions will reduce member states’ confidence in the multilateral trading system.

Therefore, Ni Yueju suggested that in order to restore the confidence of WTO member states, apart from striving to restore the dispute settlement mechanism as soon as possible, it is also very important to promote the effective conclusion of the negotiation results of trade rules and let member states benefit from further opening up.

We will advance the WTO reform process

China is taking an active part in regional economic cooperation. We are not only pushing for the RCEP to enter into force early next year, but also applying to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and the Digital Economy Partnership (DEPA), opening the door even wider.

In this process, the relationship between regional trade agreements and WTO has always been the focus of academic research.

In this regard, Zhang jianping pointed out that free trade agreements or regional trade agreements are encouraged and supported by the WTO and need to be filed in the WTO. The WTO website also regularly publishes the number and text of regional trade agreements that have been filed and are being implemented.

Ni Yueju said that objectively speaking, if the development direction of the two is the same, and both are for the development of freer and more convenient trade and investment, more countries participating in more open and free regional trade agreements can play a role in promoting the development of multilateral trading system to some extent.

However, Ni believes that if regional trade agreements are more exclusive, such as the US-Canada Mexico agreement, or add too many geopolitical factors, the multilateral trading system may be more corrosive.

Therefore, she believes that whether regional agreements can replace multilateral agreements to become the mainstream of national economic and trade relations in the future depends on the WTO reform process. If there is no progress in WTO reform and the three functions of WTO cannot play an effective role, this possibility cannot be ruled out.

We will firmly support safeguarding the multilateral trading system

Compared with the early days of China’s entry into wto, the world economic situation and international economic and trade pattern have changed greatly. Ni Yueju believes that first, globalization has entered a slow lane, and trade protectionism and unilateralism are on the rise.

Second, the rapid rise of emerging economies, led by China, is playing an increasingly important role in the world economy, squeezing the role of developed countries. In this new context, the developed economies led by the US have banded together to put pressure on China, trying to change the previous rules of the game and make China submit to the new rules of the game or be excluded from the new rules under the principle of “equal opening up” and “fair competition”. The salient feature of the new rules is the transition from the border to the border, pointing to China’s domestic trade and industrial policies, as well as relevant laws and regulations.

How should China respond to these challenges? What role can WTO reform play in solving the above problems for China?

“The CPTPP rules are representative of the high standards of economic and trade rules of the future. It is therefore important to stress test against high standards of economic and trade rules.” Ni Yueju pointed out.

The WTO has 164 member countries. Developing countries, with their growing economic strength, have an increasing say in the WTO. Ni believed that China, as the largest developing member country, can play a leading role in the WTO, jointly safeguard the legitimate rights and interests of developing countries and jointly promote the development of the multilateral trading system in a more free, open, fair and inclusive direction.

Zhang suggested that China should take the path of innovation-driven development in the future, pursue high-quality development, further promote institutional opening-up, especially involving cross-border flows of capital, technology, talent and other factors, and promote economic structure optimization, all of which should be carried out under the conditions of opening-up.

“The WTO rules are beneficial to China, the largest developing country, and we will firmly support and defend the multilateral trading system. At the same time, we will work hard to build a network of free trade zones covering countries and regions along the Belt and Road and promote further development of globalization.” Zhang jianping said.

1. Adjust product prices

Increase or decrease the price of the product. Raising prices can reduce product sales and avoid running out of stock. However, it is worth noting that raising the price will drive down the product ranking, which has a certain risk. And if the seller can make up the product within 2 weeks, they can use the strategy of lowering the price, of course, but also to ensure the profit of the product.

2. Emergency replenishment

Amazon sellers can make emergency replenishment from other locations, quickly ship goods to warehouse with red orders, and typically sign for them within three to five days. Seller if the goods are urgent and the customer unit price is high, can use this method for emergency replenishment.

3. Reduce your advertising budget

In-station advertising is the necessary means of in-station drainage, when the product is out of stock, can reduce the advertising budget to reduce the page view and click rate, so as to reduce the number of orders.