“In June issued a notice, in September officially announced the list of rooftop distributed photovoltaic development pilot, rooftop distributed photovoltaic construction can be said to have been fully rolled out. Proportionally, the installation scale of this round of installed heat will exceed 1000GW, which will have a market scale of more than 3 trillion yuan according to 3.5 yuan/watt.” Liu Jimao, founder of Hongda Photovoltaic, told Securities Daily that in addition to the civil market, under the national “dual carbon” target, the electricity costs of some high-energy enterprises will increase significantly, and these enterprises are also actively participating in the construction of photovoltaic power station projects.

Regarding the future development situation of photovoltaic industry, the Blockchain Application Division of Yuanguang Software gave a set of optimistic data: by 2035, the total installed capacity of photovoltaic is expected to reach 3 billion kW, and the annual power generation will be 3.5 trillion KWH, accounting for about 28% of the total social electricity consumption in that year.

Under the policy promotion and industrial focus, photovoltaic plate has become a hot topic in the market. Since The Comprehensive Department of the National Energy Administration issued the Notice on Submitting the Pilot Scheme of Rooftop Distributed PHOTOVOLTAIC Development for the Whole County (city or District) on June 20, as of October 20, the photovoltaic industry index (931151) increased by 53.40% in four months.

If you take a flight at Daxing International Airport, you will find dozens of photovoltaic panels on the outside of the runway and on the roofs of some buildings. This is China’s first photovoltaic project built next to the runway in a flight area.

Energy-saving technical service co., LTD., general manager of Beijing capital airport xue-gang li to introduce “securities journal” reporter, with the increase of the airport and the use of high power equipment, airport consumes electricity to hundred million calculation for the unit, so large power supply pressure has been the development of the airport important topics, pv projects through the airport, can effectively alleviate the airport area power supply side are in short supply, At the same time, energy conservation and emission reduction can be achieved, helping to build a green airport.

On the grass on the south side of the north runway of the airport, photovoltaic panels are neatly laid. Li Xuegang said that the project repeatedly demonstrated the problems of light reflection and light pollution, and finally passed the evaluation of relevant departments to determine that the construction of photovoltaic on the grass around the runway is safe and feasible. The project adopts the mode of “self-use, surplus electricity online” to provide green energy for Daxing Airport and reduce electricity cost.

Daxing District of Beijing, as one of the 676 whole counties (cities, districts) rooftop distributed pv development pilot, civil rooftop distributed PV is under construction. Yang Zhen (pseudonym), a villager in Caiyu Town, Daxing District, told Securities Daily that there were relevant policies in the village several years ago, but few people were willing to participate. On the one hand, they wanted to renovate the roof, and on the other hand, they were not interested in photovoltaic projects.

“Now it is different. I heard that there is a new policy. As long as we rent out the roof, we can install the photovoltaic and generate electricity at a lower cost for our own use. Yang Zhen said.

Since this year under the promotion of the policy, the rapid development of rooftop distributed photovoltaic, has announced the launch of the whole county rooftop distributed photovoltaic project. Reporters found in the survey, because of good prospects, high income, some residents will be called the rooftop distributed photovoltaic photovoltaic pension.

“It cost less than 90,000 yuan to install photovoltaic solar panels on my roof, which will pay back the cost in more than five years.” Li Min (pseudonym) from Hezhuang Township, Hengshui City, Hebei Province, told Securities Daily that photovoltaic power generation is sent to the grid and income is paid each month according to the amount of electricity generated. “The specific depends on the weather. When the sun is good, I can get up to 1,800 yuan a month. When it rained a while ago, the income was not good, but on average, I can get about 50 yuan a day.”

Photovoltaic solar panel salesman Xiao Zhang told reporters that because of the rising cost of components, before it can do more than 5 years back, but now it takes about 6 years. But in today’s market, annual returns of around 17% are still a bargain.

Notably, installing photovoltaic solar panels in rural areas is not easy. “The installation of solar panels, not want to install can be installed, mainly depends on the capacity of the village transformer, our village is only a few people installed.” Li said.

“Whether photovoltaic solar panels can be installed depends on how many people in the village install them. If more people install them, they may not be able to install them.” Zhang explained to reporters that the rural transformer capacity is limited, the general coverage is less than 5%.

To solve the shortage of rural power grid capacity is a key point for photovoltaic development. In addition, with the application of new technologies, traditional solar photovoltaic materials attached to buildings (BAPV) tend to be replaced by the new technology-led building integrated photovoltaic (BIPV), which will make pv part of the external structure of buildings.

Compared with BAPV, BIPV does not need to be fixed with a stent, Zhao Zihao, a researcher at The Head Leopard Research Institute, told Securities Daily. BIPV combines photovoltaic modules and building materials without exposure, providing greater safety and longer service life, while allowing a degree of customization. In addition to being applied in rooftop PHOTOVOLTAIC scenes, BIPV can also be used as curtain wall and sunshade in more scenes. As a photovoltaic building material, BIPV is more suitable for incremental building construction and is the key direction of future enterprise development.

At present, the rooftop distributed photovoltaic project is mainly based on the main body of the roof (property owner) renting the roof and the investor sharing the power generation income, and some of them are invested by the owner himself. , million sunshine new energy, President of Beijing QiHaiShen “securities journal” reporter said, in the policy, driven by energy type of state-owned enterprises, state-owned enterprises have been heavily into the distributed photovoltaic market, some private photovoltaic enterprises and stronger financing ability of listed companies, are also actively expand distributed photovoltaic business, business types of state-owned enterprises, state-owned enterprises + corporation cooperation is becoming more common.

Therefore, photovoltaic construction mode is also in reform, is no longer the traditional single enterprise investment contract project. Wu Decheng, project manager of a technology company, told reporters that the photovoltaic industry is actively promoting the “1+1+X” model, that is, a large energy enterprise with strength as the lead enterprise, responsible for providing funds, professionals, to assist local mapping resources, planning, overall promotion of project construction; 1 financial institution cooperates with the lead enterprise to provide green credit support; A number of local platform companies participate in the coordination and implementation of roof resources, operation and maintenance of information detection platform and so on according to the division of industry chain. Because it is to be led by large photovoltaic construction enterprises, the leading players in the photovoltaic industry are expected to gain better development space in this round of rooftop distributed photovoltaic construction.

Distributed photovoltaic can reduce the energy consumption of buildings in daily operation, and large-scale construction and new technology operation, put forward higher standards in construction technology and installation, for enterprises in the industry, will also bring a new survival of the fittest.

“Enterprises whose own products and technologies can be naturally transferred to BIPV application scenarios, or whose application scenarios of their own solutions overlap with BIPV, will have the opportunity to participate in this round of BIPV construction and development,” Yang Xiao, a researcher at The Head Leopard Research Institute, told Securities Daily.

Driven by technology, the combination of photovoltaic and architecture is getting closer and closer. Distributed photovoltaic is expected to bring huge incremental space to the entire photovoltaic industry. According to the industry forecast, in the next 1-2 years, the distributed photovoltaic market will usher in a comprehensive outbreak.

In an interview with Securities Daily, Chang Yang, president secretary of Jinkotech, said that the company has participated in the application of rooftop distributed pv projects in more than 40 counties, and most counties have completed the application to provincial energy departments. At the same time, the company has completed strategic contracts with more than 20 counties and districts, and plans to lock in a project scale of nearly 8GW.

Chang Yang said: “in the future, the company will actively play the advantages in the field of distributed photovoltaic, to promote the county as an opportunity to promote the business together. At the same time of accelerating the distribution of industrial and commercial distributed photovoltaic, gradually power consumer market.” Changyang revealed that recently, the company has joint household field partners to jointly commit to household photovoltaic project development, for household distributed projects to establish development standards and requirements.

Solar photovoltaic technology wave and incremental space also promote the expansion of the listed company, Oriental wealth, according to data from the Choice of citic industry classification of 31 listed companies of photovoltaic plates, from 2015 to 2019, only 10 start increases the financing plans of listed companies, and the scale up to 16 nearly two years, especially in 2021, Eight companies have announced plans for private increases.

Jufeng Investment chief investment adviser Zhang Cuixia said that since the beginning of this year, photovoltaic industry policy, especially the distributed photovoltaic field has a clear policy drive and incremental space release, photovoltaic plate has become the focus of market funds and investors.

Zhang Cuixia told Securities Daily: “In recent years, the performance and stock price of listed photovoltaic companies fluctuate greatly. On the one hand, the supply and demand of the industrial chain is affected, such as silicon cells, photovoltaic glass and other links have appeared imbalance between supply and demand, so photovoltaic companies with upstream and downstream integration are more favored by capital; On the other hand, with the spread of photovoltaic construction, the increase of related operation and management costs, but also promote the use of digital technology to improve efficiency of enterprises in the industry, in addition to the scale of competition, photovoltaic enterprises’ scientific and technological hard strength and comprehensive cost control ability, has become an important standard for the market to evaluate the company’s valuation.

Digital technology represented by blockchain has played an increasingly important supporting role in the sustainable development of photovoltaic industry, and has begun to penetrate into the commercialization of power generation.

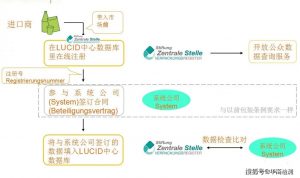

“‘ distributed ‘is the core concept of blockchain, energy Internet and blockchain naturally fit, especially distributed energy, the development of distributed photovoltaic can reflect this feature.” Huang Zhaoci, general manager of Blockchain application Division of Yuanguang Software, told reporters that power energy is a means of production but also a commodity that can be directly traded, with market value. In the future, with the optimization of energy structure and the development of power generation grid-connected, it is expected to form a blockchain with individual, collective and national energy development as nodes.

Huang Zhaoci believes that through investment behavior made by photovoltaic power station, the energy generated is both production material and goods, to block chain technology to construction of distributed energy trading platform, using smart contracts in this scene, in the form of a “double hung double pick” in the distributed energy within the scenario simulation rules of the market pricing, can better reflect supply and demand and market value. At the same time, it can promote the investment of social capital in photovoltaic power stations, meet the national energy development direction and requirements, and create more clean energy to optimize the energy structure.

In addition to trading, blockchain technology also has many application scenarios in the current photovoltaic subsidy settlement. In the calculation of electricity charges, financial rules are linked into smart contracts to form a consensus mechanism to realize automatic calculation and information sharing. If invoice robots are introduced to connect pv users, businesses and finance, an intelligent settlement system based on blockchain and artificial intelligence can be built.

About block chain with application scenario for the grid system, its block chain technology company director wang dong to journalists, for example, in early September this year, Beijing electric power trade center started the national pilot green electricity market transactions, and the pilot transaction based on block chain, a new generation of information technology as the market main body to issue “green electricity consumption proof” can be traced back.

Wang dong said that under the guidance of the “dual carbon” target, green development is the general trend. New energy, mainly distributed photovoltaic, has become the main participant in the energy and electricity market. As a distributed accounting technology, block chain has the technical characteristics of irrevocable and untamper-able, which are highly compatible with the business form of power transaction. With the continuous improvement of the green electricity market, non-source, network, load and storage multi-market players enter the green electricity market. Blockchain technology will provide a credible and reliable regulatory environment and an efficient and safe business environment for the green electricity market.