PSI process for desumidificador product;

Randomly Selected Samples:

AQL sampling inspection is a statistical method that randomly selects a small number of products (samples) from a batch of products for inspection to determine whether the batch of products are qualified.

Product quality inspection;

Product workmanship, color, specifications, function, barcode, etc will be checked based on customer’s requirements.

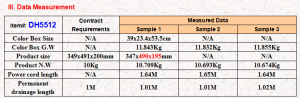

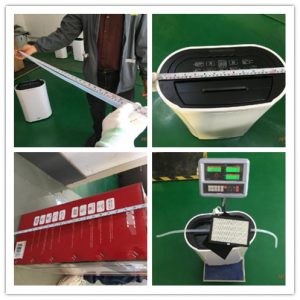

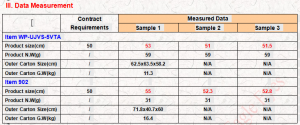

Measured data(Product size,Outer Carton size)

Special Special test for desumidificador products.

Special Special test for desumidificador products.

1.Power test(230V 50Hz) Touch control on panel checking: Functions on product specification work; Standby Power consumption < 1 W.

2.Electrical Safety conpliance Analyzer(1800Vac, 0.5mA, 2Sec; Grounding resistance test — less than 0.1 ohm at 25A).

3.Timer function checking: Time Setting is 00 hour – 1 hour – 24 hours, interval by 1 hour.

4.Smart Mode: automatic adjustment of the humidity comfort level to 55%.

5.Humidistat selected between 35-80% check

6.Humidity indicator check

7.Intelligent defrost check

8.Tank full alarm check

9.Stability test

10.Power cord pull force testing:10kg

11.Markings durability test(3M Tape test & 95% Alcohol rubbing test)

12.Barcode Scan

13.Life test(4 hours)

14.UV light check

15.Auto swing function

16.Drop test

17.Roller test(4 wheels testing)

18.Carry handle

19.Tank capacity

20.Overheating protection Test

21.Water leakages check

22.Moisture removal and air volume test

23.Air purifier function check

24.Internal check

25.Speed measure(620±50 r/,min) 230V

Packing check(color box,out cartons.)

Packing check(color box,out cartons.)

Checking whether the package is fit for transport and meets customer requirements

Inspection Report

Once the pre-shipment inspection is completed, a report will be provided within 24 hours, an overview of key findings, and a detailed account of the inspection results. All the original photos, videos, original testing data are contained, so you can see exactly what was discovered.

Packing check(color box,out cartons.)

Packing check(color box,out cartons.)